Grouped heterogeneity in linear panel data models with heterogeneous error variances

Published in Journal of Business Economic Stastistics, 2024

Grouped heterogeneity in linear panel data models with heterogeneous error variances

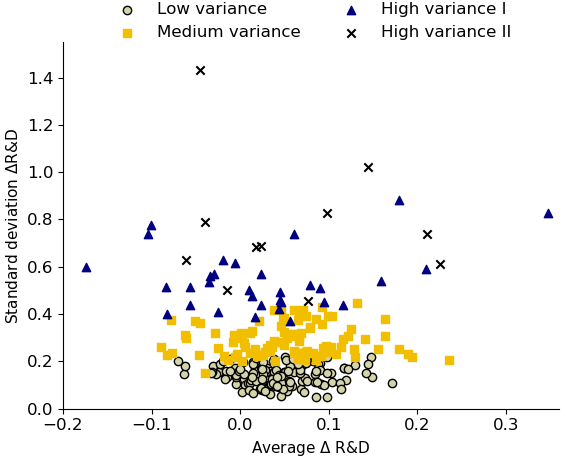

Joint with Tom BootWe develop a procedure to identify latent group structures in linear panel data models that exploits a grouping in the error variances of cross-sectional units. To accommodate such grouping, we introduce an objective function that avoids a singularity that arises in a pseudo-likelihood approach. We provide theoretical and numerical evidence showing when allowing for variance groups improves classification. The developed procedure provides new evidence on the relation between firm-level R&D investments and the business cycle. We find a well-defined group structure in the variances that ex-post can be related to firm size. Our estimates indicate stronger procyclical investment patterns at medium-size firms compared to large firms.

Download paper here